WELCOME TO PAYZORA

Modern Payment Infrastructure for Faster Pay-Ins & Payouts

Built on secure partner bank integrations and licensed payment aggregator infrastructure, Payzora delivers fast, reliable, and compliant payment flows—so you can scale operations without friction.

ABOUT PAYZORA

Payments & Payouts Built for Speed, Scale, and Security

Payzora is a modern payment infrastructure platform that enables businesses to accept payments and automate payouts seamlessly through UPI and bank rails.

Designed for reliability and scale, our platform is powered by secure partner bank integrations and licensed payment aggregator infrastructure.

Bank & UPI Payment Rails

Supported Use Cases

Platform Uptime

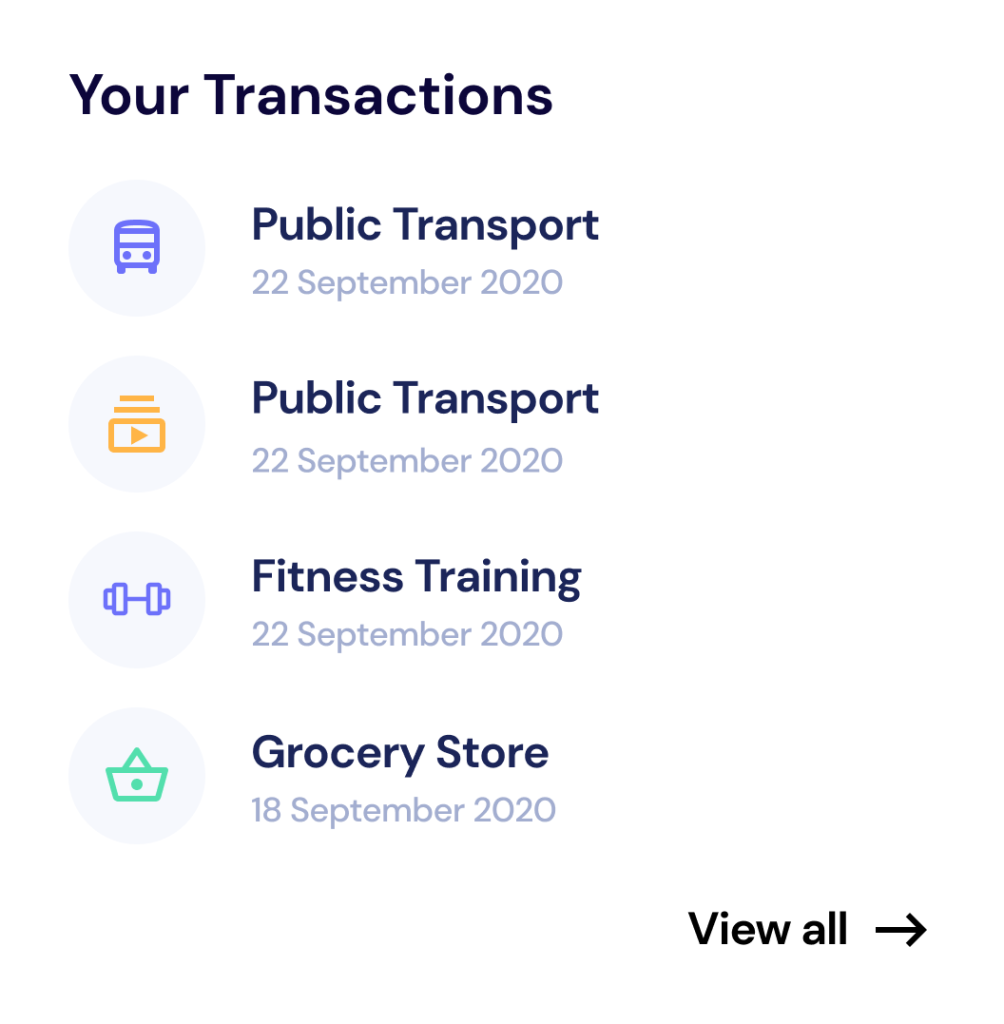

OUR PRODUCT

Complete Pay-In & Pay-Out Solutions for Modern Businesses

Payzora provides a unified platform to collect payments and automate payouts using UPI and bank rails—built on secure, compliant.

Easier Money Transfer

Integer dapibus eleifend tincidunt. Sed facilisis vulputate nisi ut vestibulum. Nulla aliquam nulla a auctor commodo.

Accept Payments Your Customers Trust

Payzora enables businesses to collect payments through popular and reliable digital methods with high success rates and real-time visibility.

Pay-In Features

UPI Intent & Collect

QR Code Payments (Static & Dynamic)

Payment Links

Bank-handled checkout flows

Real-time payment status & webhooks

Automate Payouts at Scale

Send money instantly to vendors, partners, or customers using Payzora’s robust payout infrastructure—built for speed, accuracy, and reliability.

Payout Features

IMPS / NEFT / RTGS payouts

UPI ID payouts

Single & bulk payouts

Beneficiary management

Auto-retry & failure handling

Real-time payout tracking

Built on Licensed, Bank-Backed Infrastructure

Payzora is designed with security and compliance at its core. Our platform operates on licensed payment aggregator infrastructure and secure partner bank rails to ensure every transaction meets regulatory and operational standards.

Security & Compliance Highlights

Licensed payment aggregator–powered infrastructure

Secure partner bank integrations

Bank-grade encryption for data & transactions

Role-based access and API security

Audit-ready reports and reconciliation logs

No Wallets. No Fund Holding

We never hold customer funds—transactions move directly through licensed banking and payment aggregator rails

Bank-Friendly & Audit-Ready

Built for compliance from day one, Payzora’s infrastructure supports clean reconciliation, traceable transactions.

API-First & Scalable by Design

Payzora is engineered for API-first businesses with configurable pricing, flexible workflows, and scalable architecture.

SECURITY & COMPLIANCE

Security Comes First. Compliance Comes Standard.

End-to-End Encryption

All data transmitted through Payzora is protected using HTTPS/TLS encryption, ensuring secure communication between your systems, users, and banking partners.

Secure API Authentication

Payzora uses token-based authentication and signature validation to protect APIs from unauthorized access, making integrations safe and reliable.

Verified Webhooks

Every webhook event is cryptographically verified to ensure authenticity, preventing spoofing and ensuring accurate transaction updates.

Role-Based Access Control

Define granular access levels for teams and systems. Control who can view, initiate, approve, or manage transactions with enterprise-grade permissions.

PCI DSS Aligned Architecture

Payzora does not store or process card data. Card payments are handled via secure, hosted checkout pages provided by licensed partners.

SAQ-A Eligible Model

Our architecture is designed to qualify businesses for PCI DSS SAQ-A, significantly reducing compliance scope and operational overhead.

SIMPLE WORKFLOW

How Payzora Makes Payment Operations Easy

Payzora simplifies the entire payment lifecycle—from collections to payouts—using secure bank rails and licensed payment infrastructure.

Step - 01

Integrate & Go Live

Merchants integrate Payzora using APIs or the dashboard to enable payment collection.

Step - 02

Collect Payments Securely

Customers make payments using UPI and bank-based methods.

Step - 03

Settle & Payout with Confidence

Collected funds settle directly into the merchant’s bank account.

FAQ

Frequently Asked Questions

No. Payzora does not hold funds at any point. All collections and settlements are processed directly through licensed payment aggregator and partner bank infrastructure, with funds settling into the merchant’s bank account.

Payzora supports UPI-based payments and bank rails, including UPI collect, intent flows, QR payments, and bank-handled checkout flows.

Merchants initiate payouts via Payzora’s dashboard or APIs. Payouts are then securely processed by partner banks using IMPS, NEFT, RTGS, or UPI, depending on the use case.

Yes. Payzora operates on licensed payment aggregator infrastructure and follows a bank-friendly, compliance-first model aligned with applicable regulatory requirements.

CONTACT US

Let’s Build Secure Payment Infrastructure Together

Our team is here to help you understand how Payzora can support your payment and payout operations with speed, security, and scale.

- Call Us - +91 96029 53411

-

Mail Us - info@payzora.in

support@payzora.in - Address - Shop no. B-17, 2nd Floor, Plot 781, Dadabari, Kota, Rajasthan 324009